Technology Driven Concierge Services For You

Online portal with personalized

home search results

Special savings on closing costs

and downpayment

Step by step guidance through the process and paperwork involved with buying a home

Strategic marketing plan implemented to bring top dollar offers when selling a property

Complimentary pre-listing inspection walkthrough

and move-out cleaning

Significant discounts when selling and buying

at the same time

Why Us?

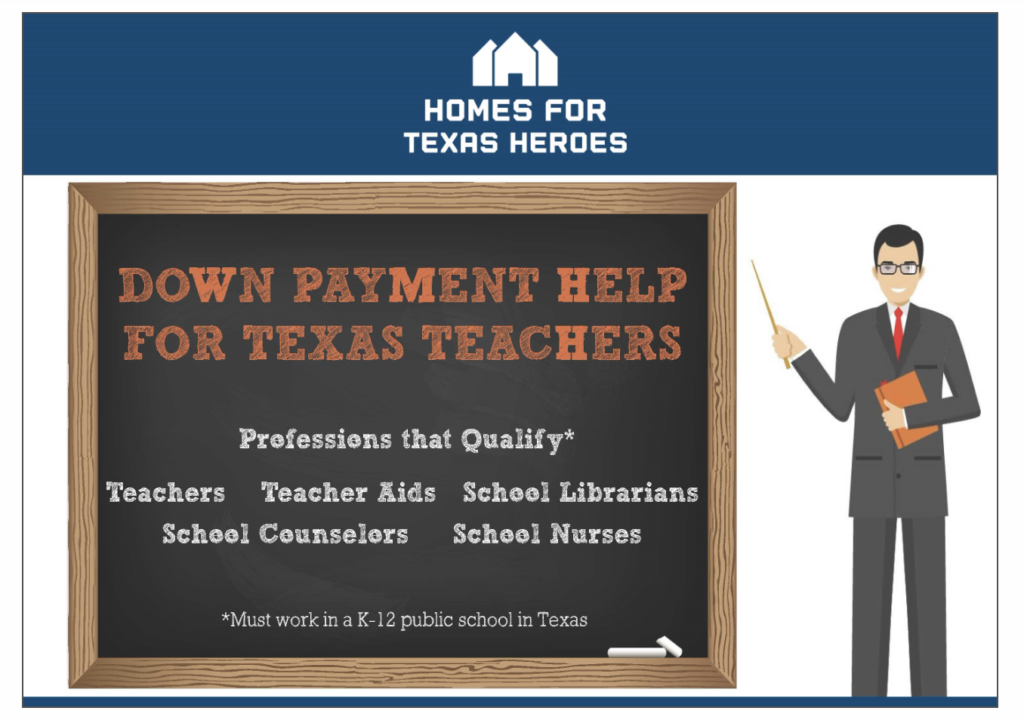

Not only do we work with the Homes for Texas Heroes TSHAC program for down payment assistance, we have a list of trusted lending partners who offer discounts to our clients in your profession. There are multiple programs to assist with the cost of buying a home. Crimson Realty understands the demand associated with being an educators and will structure the process around your schedule.

Are You A First-Time Home Buyer?

If you are a first-time home buyer (see definition here), you can apply for a mortgage interest tax credit known as a Mortgage Credit Certificate (MCC). An MCC reduces your federal income taxes every year by allowing you to get 20% of what you spent on mortgage interest back as a tax credit. Because the tax credit refunds a portion of your mortgage interest, it also effectively reduces your mortgage interest rate.

Plus, if you use an MCC and Down Payment Assistance together, your MCC is free—an additional $500 in savings!